Which transactions will be considered for STP submission?

When entering payroll transactions, the system will pickup the following transactions for STP submission:

- Pay Wages

- Employee Dividends

- Ad hoc entries allocated to employees that have been added to a batch

If an entry is allocated to an employee the system automatically recognises the entry as requiring STP submission.

STP Batches

STP transactions are added to payroll batches and become available for STP submission. (Note: you may also process a "Current Year Submit", "full year submit" or "Prior Year Update" which will pick up entries that are not in a batch).

Single Touch Payroll submission process

Once you have posted a STP payroll batch, you will be able to submit the STP payload directly to the ATO from your desktop software.

How do I view a STP Batch?

When do I need to submit my STP following the pay event?

You need to submit STP on the pay date (which would be the same day as the payroll or the next day depending upon when a funds transfer is made payable to the employees). See ATO guidelines.

Submission

The STP submission process follows the following steps:

- Entering Data Inputs

- Data Validation and Schema Validation

- Submitting the STP Batch

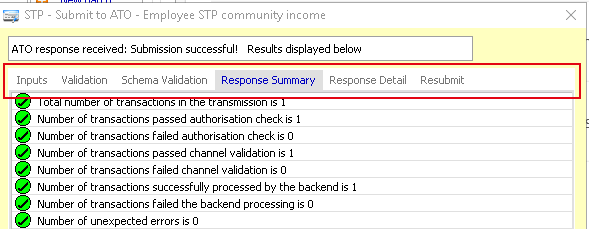

- Responses and Resubmission

- Batch Reports

- Batch Totals

Next: See Data inputs

Comments

0 comments

Please sign in to leave a comment.